Davis Industrial Report

2025–2026 U.S. Industrial Real Estate Outlook

Executive Snapshot & Key Takeaways

A Market in Transition: From Post-Pandemic Surge to Stabilized Growth

The U.S. industrial real estate sector has entered a new phase marked by normalization, supply discipline, and renewed tenant demand. After absorbing a historic wave of new construction in 2023–2024, the market in 2025 stabilized, setting the stage for more balanced and sustainable growth in 2026—particularly across high-growth regions like the Carolinas and supply-constrained markets such as Asheville.

National Highlights

Leasing Momentum Rebounded in 2025

~940 million SF of leasing activity nationally

Net absorption of ~150 million SF, with more than half occurring in the second half of the year

Vacancy Stabilizing After Peaking

National vacancy near 6.7%–7.0%, with new supply deliveries falling sharply

Development Cycle Reset

Construction starts down more than 30% from peak levels

Build-to-suit and pre-leased projects now dominate new pipeline

Rents Remain at Historic Highs

National average asking rents around $10–11/SF NNN

Growth moderating but still positive in most major markets

2026 National Outlook

Demand expected to continue recovering as:

Reshoring and manufacturing investment accelerates

E-commerce and logistics networks expand regionally

Vacancy projected to gradually compress as:

New supply pipeline shrinks

Leasing velocity improves

Capital markets anticipated to re-engage as:

Interest rates stabilize

Institutional buyers target modern logistics and infill product

Carolinas Regional Highlights

One of the Strongest Growth Corridors in the U.S.

Benefiting from population growth, port access, and manufacturing expansion

Charlotte & Upstate SC Leading Demand

Record or near-record leasing in modern distribution facilities

Vacancy stabilizing after peak construction cycle

Charleston Working Through Oversupply

Elevated vacancy due to recent speculative deliveries

Long-term fundamentals supported by port-driven logistics and advanced manufacturing

2026 Outlook

Tightening conditions in core submarkets

Continued rental outperformance versus national averages

Increased build-to-suit and owner-user activity

Asheville Industrial Market Snapshot

Highly Constrained, Structurally Tight Market

Total inventory: ~36.8 million SF

Vacancy: ~3.9% (well below national average)

Limited New Supply

Only ~230,000 SF under construction (≈0.8% of inventory)

Strong Rent Fundamentals

Average asking rent: ~$10.25/SF

Five-year average annual rent growth: ~7.6%

Investment Market

Average pricing: ~$94/SF

Cap rates: ~8.1%

2026 Outlook

Vacancy forecast to remain under 4.5%

Rent growth projected to continue outperforming national averages

Demand supported by regional manufacturing, distribution, and limited land availability

Download the Full 2025–2026 Industrial Market Report for:

In-depth national, regional, and local analysis

Detailed vacancy, rent, absorption, and construction trends

Capital markets and investment outlook

2026 projections and strategic insights for tenants, investors, and developers

Asheville, North Carolina and Carolinas-specific CoStar data and submarket breakdowns

2025

Fresh Beginnings: Asheville MSA Year-End 2025 Commercial Market Report

Commercial Real Estate Insights

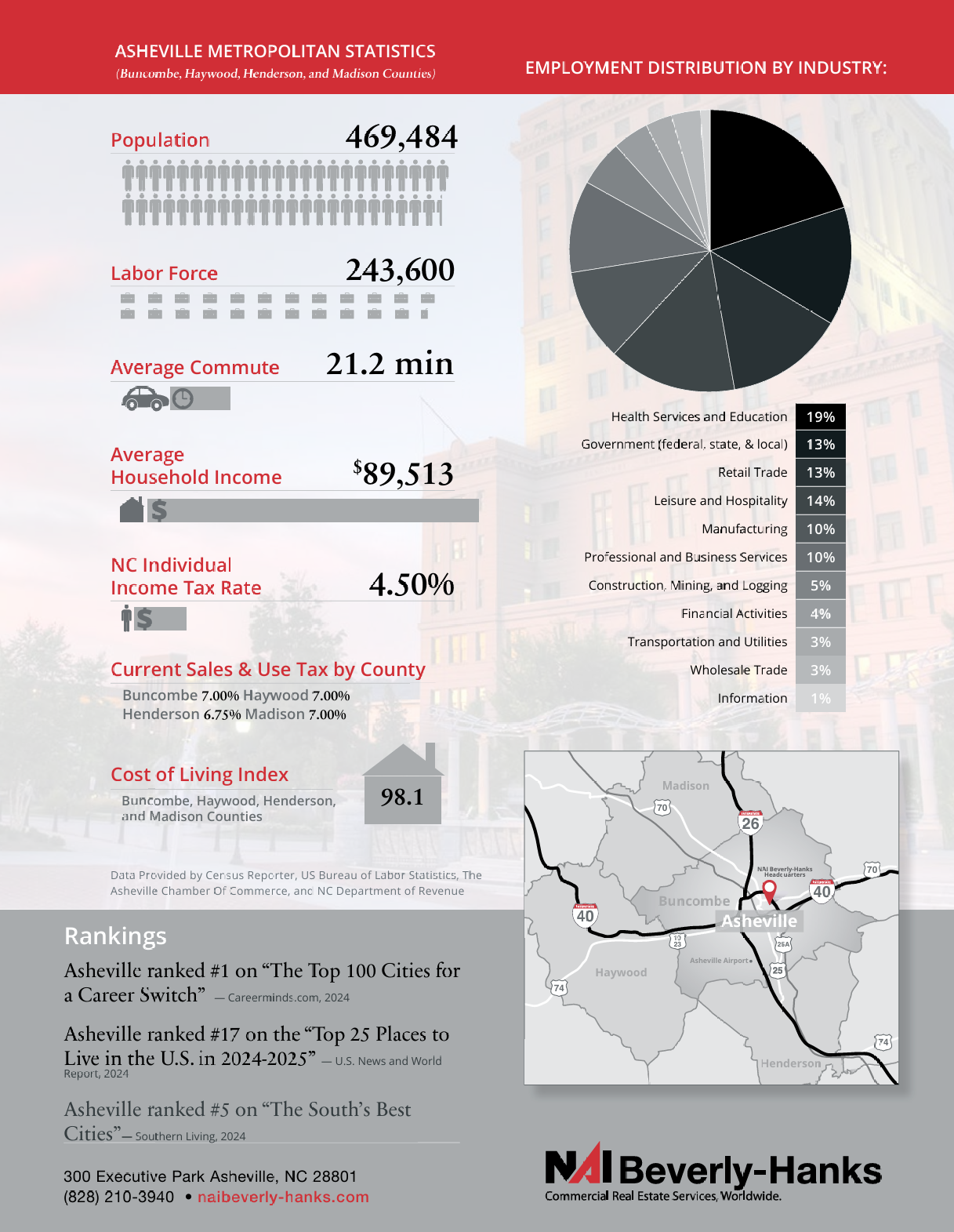

Asheville’s 2025 commercial market was severely hampered by the lingering effects of Hurricane Helene, which hit the region in full force in late September 2024, as well as the wildfires that hit the region in January. As the year dawned, much of the business we saw was generated by local companies picking up and relocating thanks to the damages they sustained. As the year progressed, we saw tight financial markets across the region as businesses were strained with lower tourism volume and income.

But the nature of this year brought many fresh beginnings, as well. With rebuilding came a fresh approach to community organization. This is perhaps best embodied by the city’s three-year contract with the Asheville Downtown Improvement District (ADID) as the service provider for the business improvement district (BID).

Locals were thrilled to see many of their favorite restaurants and bars reopen in new spaces or in a new scope. For example, Mean Pies, previously a food truck at plēb, reopened at OWL Bakery. DayTrip opened at a new spot on Broadway Street just outside downtown Asheville. Tiger Bay Cafe is now at a new location inside Ben’s Tuneup. And Zella’s Deli has a new location on Tunnel Road. A blast from the past, Chorizo recently reopened in the Grove Arcade after closing in 2016!

And as long-loved restaurants found new homes, fresh concepts and leaders emerged, as well. New businesses opened, including Hail Mary in West Asheville, Short Sleeves Coffee in Swannanoa, Foothills Watershed in Old Fort, and Periscope Bar at the S&W Market.

The arts community saw similar rebuilding and rebalancing efforts. Local artists took over Cheap Joe’s art supply shop, transforming it into Asheville Art Supply. Resurrection Studios Collective moved into the former MOOG Music building on Broadway Street next to DayTrip. And in February, Asheville Art Museum’s exhibit, “Asheville Strong: Celebrating Art and Community After Hurricane Helene”, became a rallying cry for the community that was heard throughout the year.

All of this is to say that even through our struggles over this last year, our region’s vacancy rates are generally lower than the national average. In retail, we’re at 1.8% compared to the U.S. average of 4.3%; 2.9% in industrial compared to the U.S. average of 7.7%; and 2.4% in office vacancies compared to 14.2% in the U.S. Investing in our region remains a strong choice with lower risk than in many other areas.

Looking forward, many of the community projects and initiatives listed above will continue well into the new year. However, we also see 2026 as a year of returning to “business as usual”—and that’s a good thing! Asheville does indeed remain “Asheville Strong”.

Q4/Year-End 2025 Commercial Sales Activity Review:

2 Industrial Transactions for $7.9 million

21 Office Transactions for $43.2 million

26 Retail Transactions for $26.1 million

10 Multi-family Transactions for $42.2 million

9 Land Transactions for $9.8 million

Q4/Year-End Commercial Lease Activity Review:

12 Industrial Lease Transactions, Vacancy Rate of 3.1%

27 Office Lease Transactions, Vacancy Rate of 2.3%

16 Retail Lease Transactions, Vacancy Rate of 1.6%

All information represents 2025 data as provided by CoStar for the region.

About the Featured Listing

701 Oriole Drive in Hendersonville

MLS#: 4313050 | 72,784 SF | $3,950,000

Listed by: Jim Davis, SIOR

Discover the Oriole Mill, over 72,000 SF of highly adaptive space, minutes from downtown Hendersonville. This two-story facility offers unmatched flexibility for industrial, manufacturing, or adaptive reuse projects. Sited under flexible zoning with additional versatility within the structure, the site features numerous drive-in doors, dock doors with a full-length loading deck along a formerly active rail spur, and access on all four sides. Located near the Oklawaha Greenway, the property also includes additional land that could be ideal for parking or a laydown yard. Whether you’re looking to scale operations or reimagine a legacy space, Oriole Mill is a rare opportunity in a rapidly growing market.